The text discusses Bitcoin’s market‑euphoria signals, historical ATH patterns and correction risks visible in on‑chain data.

Bitcoin continues its strong rally, setting new records amid rising spot demand and a sharp increase in AUM of U.S. ETFs. At the same time, growing profit-taking activity is being observed, potentially signaling an upcoming market correction.

On November 13, 2024, Bitcoin reached an all-time high of USD 93,483, marking a 120% year-to-date increase. According to Glassnode, over 95% of the circulating supply is currently in profit.

"Historically, euphoria phases with 95% of supply in profit have lasted an average of 22 days before profit-taking begins," Glassnode reports. The current phase has lasted 12 days.

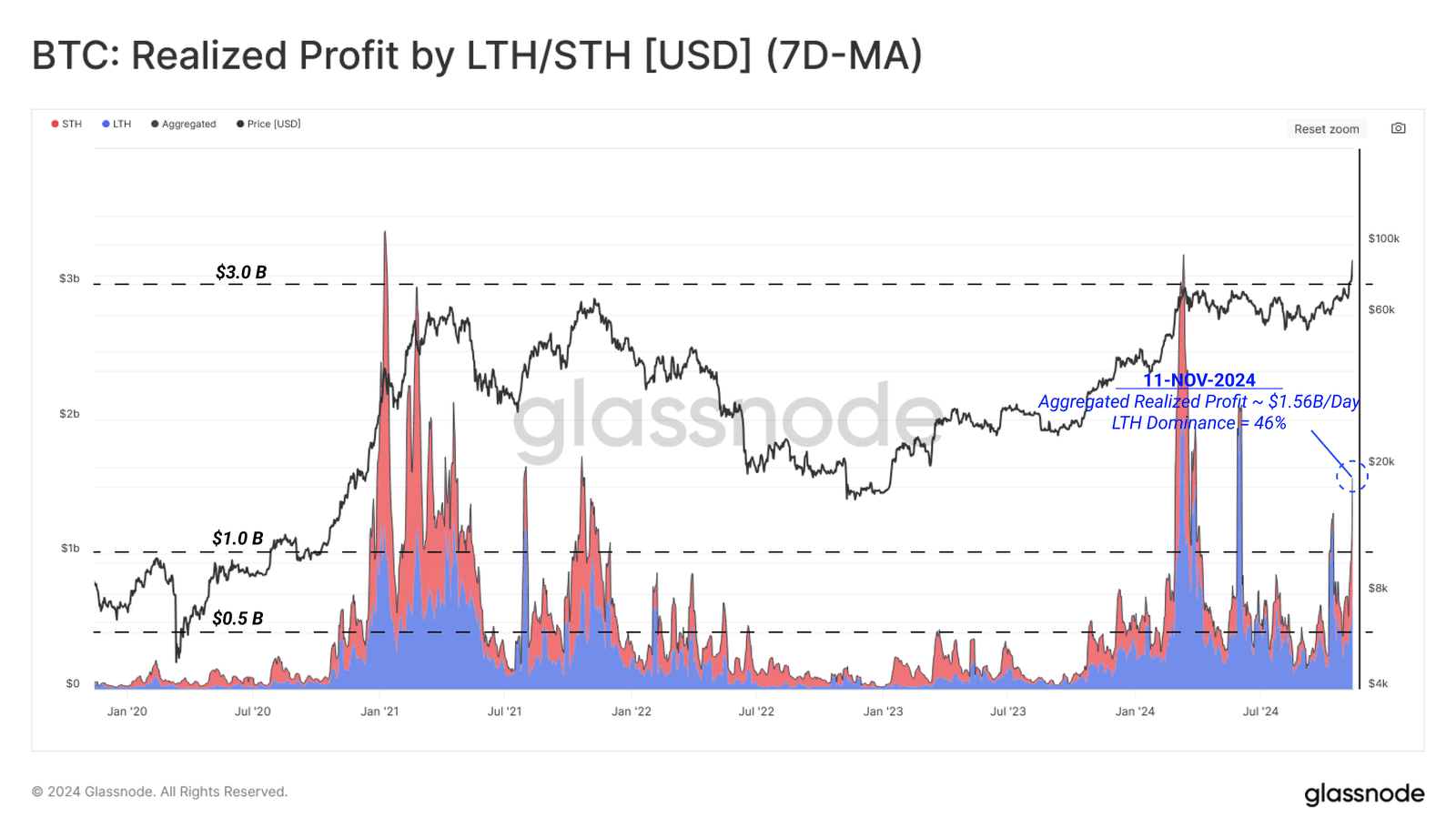

Historical data indicates significant corrections following periods of record-high prices. Current realization levels—USD 1.56 billion per day—remain below the peaks observed in previous cycles (USD 3 billion).

"At present, long-term holders account for 46% of daily realizations, showing a moderate inclination to sell," according to Glassnode

Cumulative profits have exceeded USD 20 billion since entering the ATH phase. In previous cycles, this figure reached USD 30 billion prior to a correction.

"The current situation combines moderate profit-taking with strong spot demand," comments Glassnode.

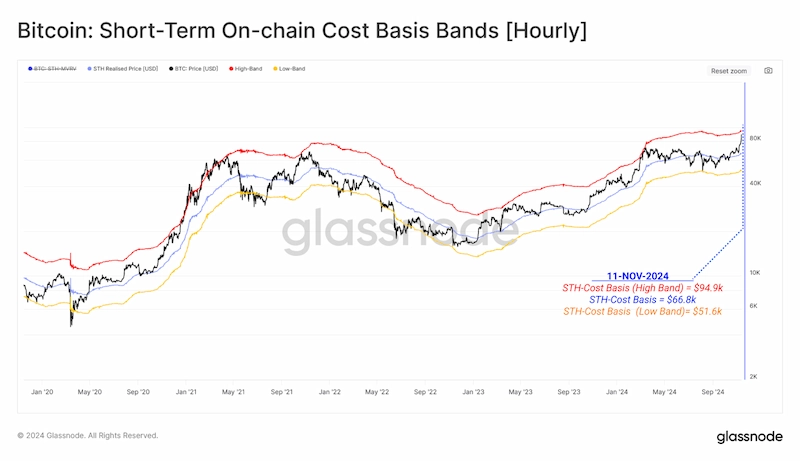

Upper statistical bands of acquisition cost indicate a key level at USD 94,900. "Demand at cost levels above USD 87,900 remains strong," according to a Glassnode report.

On-chain data suggests upward potential as the market approaches a zone of intensified profit realization. Investors are advised to monitor technical indicators and market dynamics to respond appropriately to trend shifts.

.webp)